How Data-Driven Agent Networks Transform Real Estate Marketing in 2026

Email still delivers an average of $36-42 in revenue for every $1 spent, making it the highest-ROI digital channel, but only when campaigns are highly targeted and relevant. Platforms like Blastrow layer MLS-driven targeting, AI optimization, and hyper-local agent coverage on top of listing blast campaigns, turning email from an instrument into a precision agent-to-agent network that reliably generates showings, referrals, and closed deals.

Traditional real estate marketing built around cold leads, generic email blasts, and expensive portals is being replaced by data-driven agent networks that match listings with agents who already have qualified buyers. In 2026, falling mortgage rates, rising inventory, and renewed buyer demand collide with maturing proptech, creating a perfect moment for collaborative, network-based strategies.

This blog breaks down how and why agent networks are replacing traditional marketing, what the 2026 market backdrop looks like, the economics of network-based campaigns, and actionable playbooks for agents, investors, and institutions.

1. Why 2026 is the tipping point

1.1 From frozen to flowing transactions

Between 2022 and 2024, locked-in low mortgage rates, thin inventory, and high prices kept many owners and buyers on the sidelines, depressing transaction volumes even in strong job markets. NAR and other housing economists describe these years as constrained by "rate lock-in" and affordability challenges that limited mobility.

By late 2025, forecasts shifted: NAR projected a roughly 14% increase in existing home sales and a 5% uptick in new-home sales for 2026, with home prices rising a more moderate 4% as inventory improves. CREA data similarly showed Canadian home sales holding steady and edging higher into 2026, with listings starting to normalize from historically low levels.

In a market where transactions are growing again, the limiting factor becomes not demand, but how efficiently agents can match specific buyers to specific listings - exactly the problem agent networks are designed to solve.

1.2 A polarized buyer base

The current housing cycle is marked by polarization: cash buyers have reached about 26% of purchases, while first-time buyers remain at or near historical lows around 21%, according to NAR and related reporting. Zillow's consumer research shows many younger buyers are constrained by student debt, high rents, and down payment challenges, even as investor and move-up segments remain active.

This means markets no longer respond to broad, generic campaigns; luxury buyers, first-time buyers, and investors each respond to different price points, messaging, and neighborhoods. Networks that can route listings to agents specializing in these niches - luxury, investment, relocation, entry-level - naturally outperform one-size-fits-all blasts and portal ads.

1.3 Proptech and software maturity

Analyst reports estimate the residential and commercial proptech "agent tools" segment in the multi-billion-dollar range in 2025, with projected growth to well over double by the mid-2030s. Broader real estate software - CRM, transaction management, analytics - is also expected to grow strongly, reflecting widespread adoption of cloud tools and automation by brokerages and teams.

Zillow, CoStar, and Realtor.com command significant consumer-facing market share, but the fastest innovation is happening in B2B: MLS-integrated analytics, referral marketplaces, high-ROI email tools, and agent-to-agent networking platforms. These tools make it feasible to target specific agent cohorts, track engagements, and optimize listing promotion in ways that simply weren't possible a decade ago.

2. The economics of data-driven agent networks

2.1 Why email blast campaigns still win on ROI

Across industries, email consistently delivers one of the highest marketing ROIs - around $36-42 for every $1 spent. In real estate, average open rates hover in the 20-25% range, with well-segmented campaigns frequently hitting 30-40% or higher.

The problem is not email itself; it is how email is used. Generic "spray and pray" campaigns to massive lists of barely-relevant recipients generate low open rates, virtually no replies, and a negative or marginal ROI once design and list costs are included. In contrast, agent-to-agent listing blasts aimed at carefully selected local professionals - those who actively close in the area or have matching buyers - turn the same channel into a high-conversion, low-cost network engine.

2.2 Performance comparison: generic vs targeted vs AI-powered

The performance gap becomes obvious when comparing key metrics across three campaign types.

| Metric | Generic email blasts | Targeted agent blasts | AI-powered agent networks |

|---|---|---|---|

| Open rate | ~8-15% | ~25-40% | ~30-45% |

| Reply rate | ~0.1-0.3% | ~1.4-3.2% | ~3-5% |

| Conversion to meetings | ~0-1% | ~2-4% | ~3-5% |

| Typical ROI (per $1 spent) | Low / often negative | ~2,400-4,700% | ~3,600%+ |

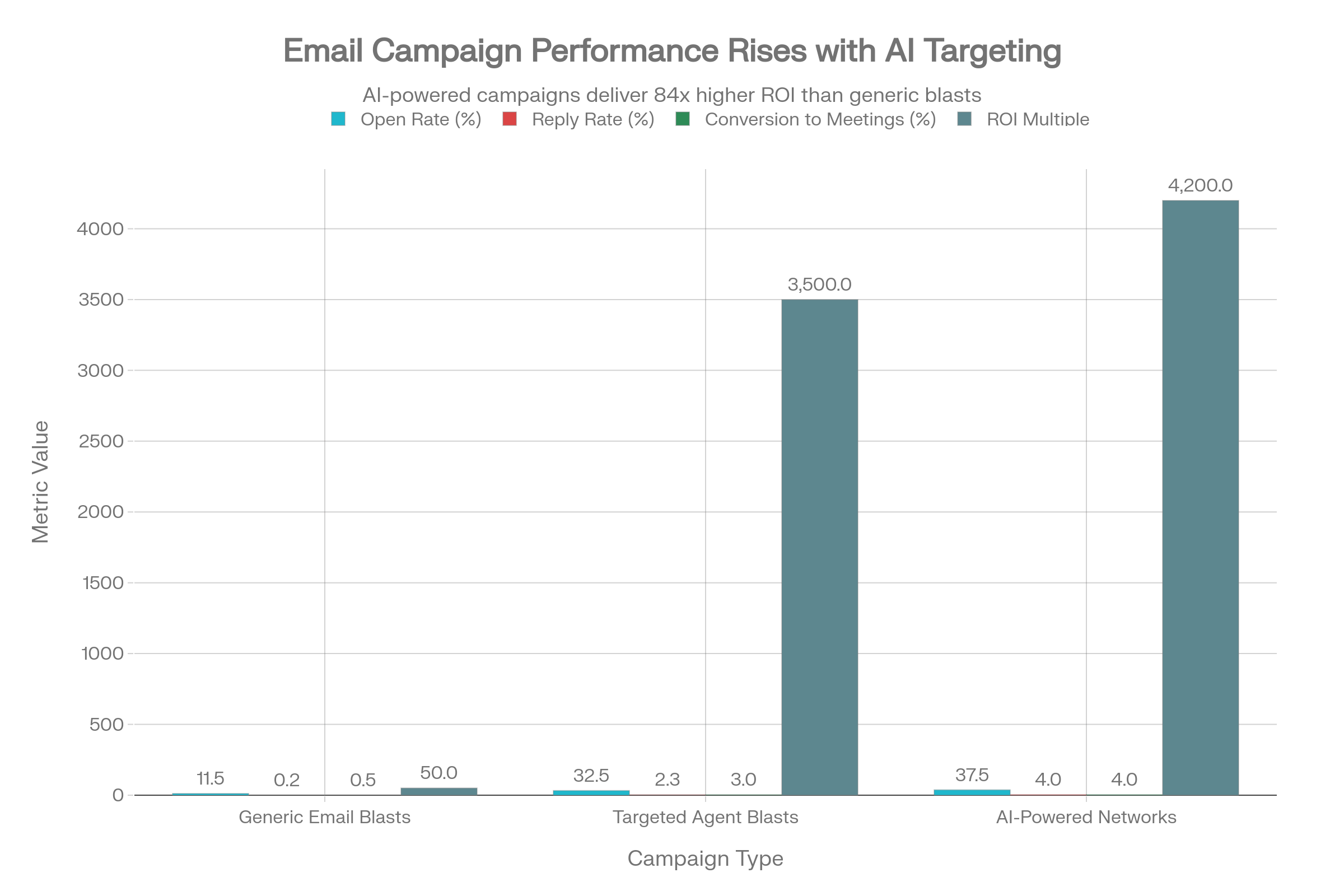

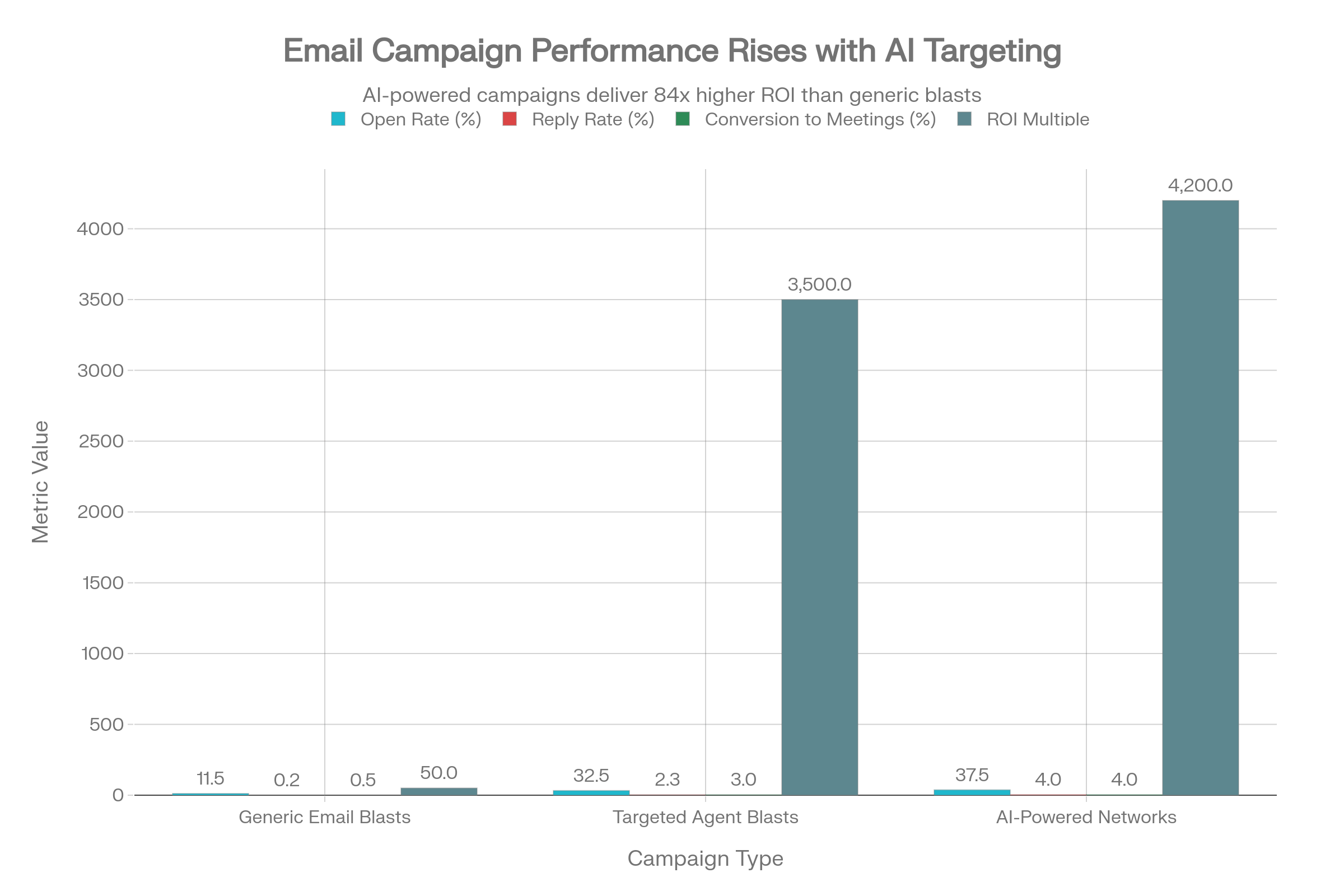

2.3 Chart 1: Email campaign performance comparison

Performance comparison shows targeted and AI-powered email campaigns dramatically outperform generic blasts across all metrics

The first chart visualizes these differences across open rate, reply rate, conversion to meetings, and ROI multiple for three campaign types - generic blasts, targeted agent blasts, and AI-powered network campaigns.

Performance comparison shows targeted and AI-powered email campaigns dramatically outperform generic blasts across all metrics

It shows that generic blasts produce modest open rates and negligible replies, while targeted agent campaigns and AI-network campaigns dramatically outperform on all metrics, especially ROI. This is why serious listing agents are reallocating budget from cold list rentals and portal spend to smaller, more focused agent networks that consistently generate real conversations and offers.

2.4 Per-deal economics

Comparing per-deal economics further emphasizes why networks are displacing legacy marketing.

| Campaign type | Approx. cost per campaign | Typical net profit per deal | Relative profit multiplier |

|---|---|---|---|

| Generic email blasts | High (list + design) | Low (few deals, small margin) | 1× baseline |

| Targeted local campaigns | Moderate | High (several deals/year) | ~6× baseline |

| Agent network campaigns | Low (pay per 100 agents) | Very high (single deal covers months of spend) | ~30-34× baseline |

A single referral deal generated from a well-targeted network blast can pay for many months - or even years - of campaigns, especially when cost-per-100-agent pricing is available.

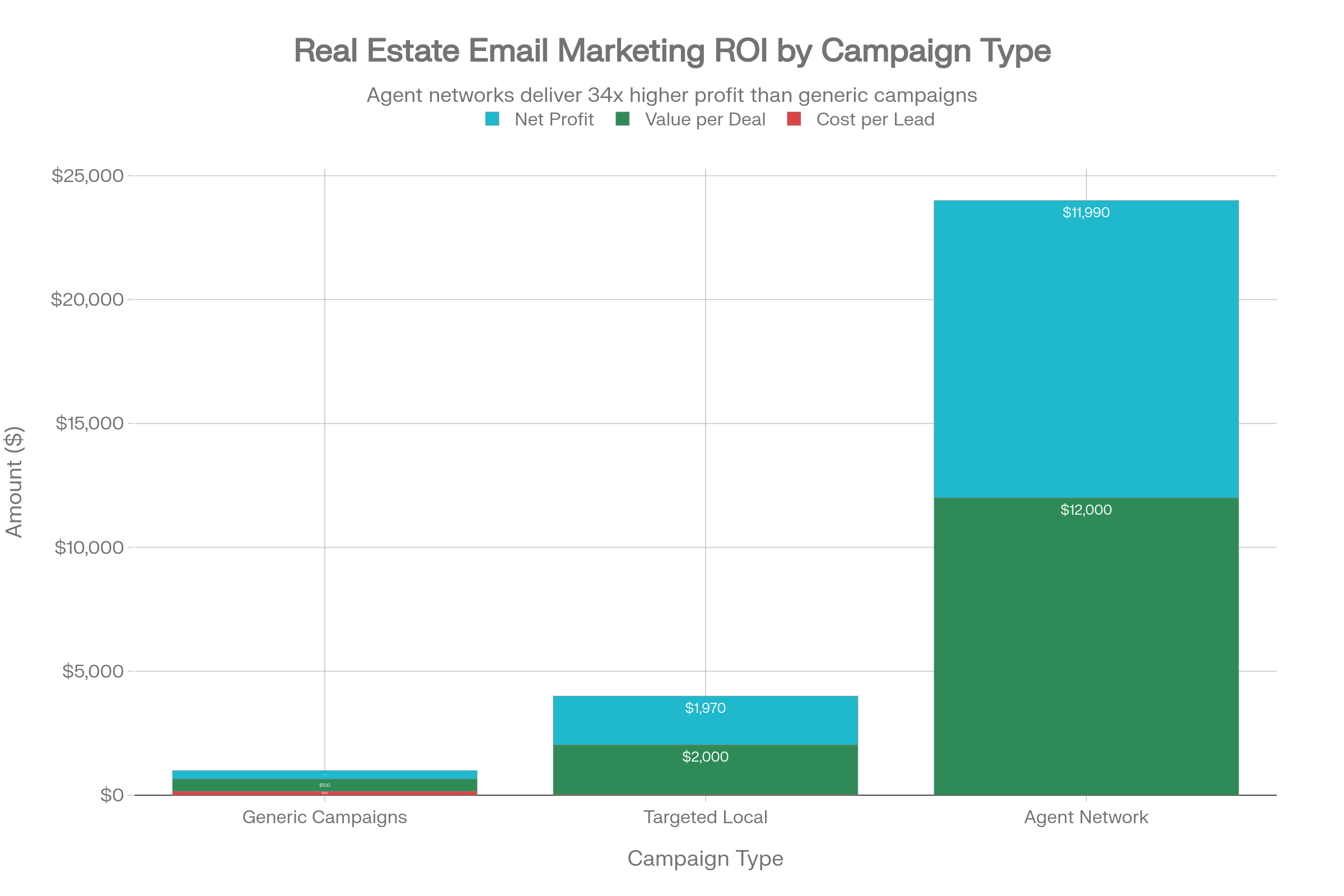

2.5 Chart 3: ROI components per campaign type

Breakdown of per-deal economics shows agent network campaigns deliver 34x higher profit than generic approaches

The third chart presents a stacked bar view of cost per lead, value per closed deal, and net profit per deal across generic, targeted, and agent network campaigns.

Breakdown of per-deal economics shows agent network campaigns deliver 34x higher profit than generic approaches

The visual makes clear that while generic campaigns have relatively high costs and low deal value, agent network campaigns pair very low cost with high-value transactions, resulting in dramatically higher net profit.

3. 2026 market dynamics and agent sentiment

3.1 Optimism returns

After several years of low transaction volumes, agents are more optimistic about deal flow. A recent survey showed roughly 70%+ of agents expecting a rise in closed transactions as rates ease and more owners re-enter the market. NAR forecasts double-digit gains in existing home sales for 2026, with home prices rising modestly rather than overheating, creating a healthier balance between buyers and sellers.

In Canada, CREA data points to home sales holding steady or improving toward late 2025 and early 2026, with some local markets seeing stronger rebounds than others. This environment rewards agents who can quickly pair refreshed inventory with pent-up buyer demand through coordinated networks rather than isolated efforts.

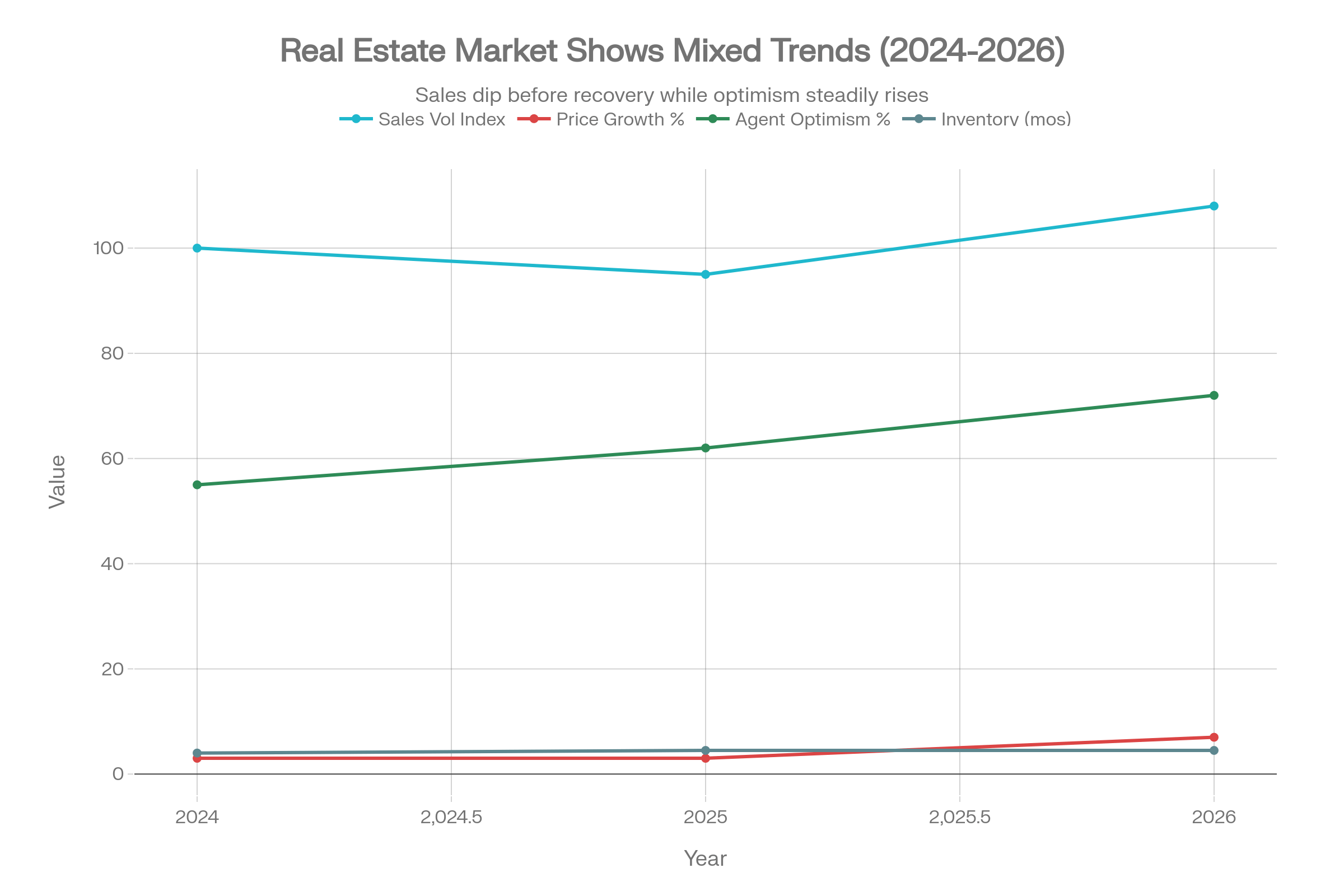

3.2 Chart 2: Market trajectory 2024-2026

Market forecasts show a significant rebound in 2026 with double-digit sales growth, higher prices, and unprecedented agent optimism

The second chart tracks a home sales volume index, price growth, agent optimism, and inventory levels from 2024 to 2026. The index dips in 2025 and then rebounds in 2026, price growth accelerates, and agent optimism climbs, while inventory moves from very tight toward more normal levels.

Market forecasts show a significant rebound in 2026 with double-digit sales growth, higher prices, and unprecedented agent optimism

Together, these curves reinforce that 2026 is a transition year: not a crisis market, but a normalized one where coordination, specialization, and data-driven promotion produce outsized results. [Yahoo.Finance]

4. Traditional vs. modern listing promotion

4.1 Traditional channels: still useful, but less efficient

Agents historically leaned on four main channels: direct mail, portal advertising, social media, and in-person events.

Direct mail: Still produces results - especially in well-chosen farm areas - but costs per mailing can be high, and response rates are sensitive to design, repetition, and demographics.

Portal leads (e.g., large search sites): Provide volume but at significant cost per lead, often with high competition and variable quality. [Thunderbit]

Social media & content: Essential for branding and nurture, but slower to turn into immediate listings or contracts.

Open houses & events: Drive local awareness and occasional walk-in buyers, but require substantial time and don't always attract serious prospects.

These methods remain part of an overall mix, yet none offer the combination of precision targeting, low marginal cost, and measurable ROI that agent network email campaigns do.

4.2 Modern network-based approaches

Modern agent networks - such as listing blast platforms and referral marketplaces - operate on a different logic: they assume that the fastest path to a buyer is often through another agent, not a cold consumer lead.

Core capabilities include:

Hyper-local agent coverage: Ability to see which agents are most active in each neighborhood or zip code.

Segmentation by expertise: Targeting luxury specialists, investors' agents, relocation experts, and first-time buyer agents differently.

Automated email campaigns: Pre-formatted flyers and campaigns that reach only agents most likely to have matching buyers.

Response analytics: Tracking opens, replies, clicks, and resulting deals to refine targeting over time.

Platforms that combine these capabilities transform what used to be a "broadcast" listing into a precise collaboration request: "Here's a property; which of you active, relevant agents has the right buyer?"

5. Competitor landscape and where Blastrow fits

5.1 Key players in agent-to-agent email flyers

Industry reports and competitive analyses show several established players in the "agent flyer" and listing blast niche.

| Feature | Legacy flyer platforms | Modern AI-powered Blastrow |

|---|---|---|

| Design | Template or designer-built | AI-assisted, fast setup |

| Pricing model | Per-campaign, region-based | Per 100 agents (low unit cost) |

| Open rate (typical/claimed) | ~15-45% | Competitive 30-45% |

| Speed to launch | Hours (with designers) | Minutes (self-serve, AI help) |

| Targeting | Broad area lists | Hyper-local + behavior-based |

| SEO impact | Limited or none | Listings indexable in search |

Blastrow positions itself as a modern, AI-first listing promotion and agent network tool: ultra-low per-agent cost, instant deployment, and a focus on hyper-local targeting and measurable ROI. By combining SEO-indexed listing pages with targeted agent blasts, it extends the reach of each listing beyond the inbox into organic search and knowledge platforms.

5.2 Advantages of AI-powered networks

Modern networks like Blastrow differentiate themselves by using AI and richer data to improve targeting and creative quality.

Key capabilities include:

AI matching: Suggesting local agents to target based on recent deals, price point, and property type.

Smart subject lines: Optimizing email subjects and preview text to lift open rates.

Creative suggestions: Recommending headlines, image layouts, and key feature highlights based on prior campaign performance.

Engagement scoring: Identifying which agents consistently open, click, or reply to prioritize them in future campaigns.

Over time, this creates a feedback loop: better targeting and copy → higher engagement → more deals → more data → even better targeting.

6. How data-driven networks change agent operations

6.1 Hyper-local targeting and neighborhood expertise

Instead of blasting an entire metro area, modern platforms allow agents to target a narrow set of colleagues who:

Have recent closings in the same subdivision, building, or district.

Work at relevant price points (e.g., $250k entry-level vs. $2M luxury).

Are known to represent investors, relocations, or specific buyer types.

This mirrors how top producers already think about their markets - but automates the process and scales it beyond personal Rolodexes. Instead of manually emailing a handful of known colleagues, agents can reach hundreds of hyper-relevant peers in a few clicks.

6.2 Real-time collaboration and transparency

Network platforms also streamline collaboration logistics:

In-platform messaging: For quick follow-ups, buyer questions, and co-list negotiations.

Shared analytics: Seeing who opened, clicked, or replied to particular listings.

Co-op workflows: Tracking co-listed deals and referral arrangements in one place.

This improves coordination between agents and reduces the friction traditionally associated with referrals and co-marketing.

6.3 Database-building and referral flywheels

Strong databases are one of the most valuable assets an agent or team can own, and networks accelerate building professional spheres.

Agents can:

Add engaged agents from campaigns into segmented "referral partner" lists.

Tag colleagues by specialty, geography, and responsiveness.

Systematically nurture these relationships with regular market updates and listing opportunities.

Over time, this builds a compounding referral flywheel: each successful collaborative deal strengthens trust and increases the likelihood of future cooperation.

7. Actionable strategies for agents

7.1 Tier 1: Shift budget to high-ROI channels

Steps for agents moving from traditional to network-driven marketing:

Audit spend: Compare cost per closing from portal leads, direct mail, and generic ads versus agent network campaigns.

Pilot 3 months: Allocate $250-500/month to 2-4 targeted listing blasts; track opens, replies, meetings, and deals.

Scale winners: If ROI passes 500-1,000%, gradually shift more budget toward agent networks.

7.2 Tier 2: Specialize and brand your expertise

Specialization improves both referral volume and conversion:

Pick a niche (luxury, first-time buyers, relocation, investors, or specific neighborhoods).

Reflect this niche consistently across website, social media, and listing blasts.

Use agent networks to connect with complementary specialists (e.g., an investor's agent partnering with a relocation specialist).

7.3 Tier 3: Advanced personalization and testing

For more advanced teams and agents:

Segment agent audiences (luxury, investment, first-time buyer, relocation) and customize flyers for each.

A/B test subject lines, hero images, and calls-to-action; adopt combinations that maximize opens and replies.

Report ROI monthly - by campaign type, segment, and platform - to refine strategy.

9. FAQ

9.1 How much should I budget for agent network campaigns?

Start with a pilot budget of roughly $250-500 per month on 2-4 targeted campaigns, track ROI for at least 3 months, and scale toward $1,000-2,000 per month if you're consistently seeing triple-digit or better returns. Because a single closed deal can cover months of spend, this channel can quickly become one of the most cost-effective parts of your marketing mix.

9.2 Why are agent networks more effective than MLS alone?

The MLS is a passive distribution system: it exposes listings to all agents but doesn't prioritize who is most likely to have the right buyer. Agent networks actively push listings to selected colleagues based on geography, niche, and recent activity, delivering far higher relevance and engagement.

9.3 How do listing flyer platforms differ, and where does Blastrow fit?

Legacy flyer tools emphasize templates or designer-built creatives and region-based lists, while Blastrow combines AI-assisted design, per-100-agent pricing, and hyper-local targeting. This makes it faster and more cost-efficient to run frequent, highly-targeted campaigns that integrate with SEO and analytics.

9.4 How can I tell if my targeting is too broad?

Use open and reply rates as a diagnostic: open rates below ~15% and reply rates under ~1% usually indicate overly broad audiences. Tightening geography and focusing on agents with recent relevant closings typically lifts opens into the 25-35% range and replies into the 1.5-3% range.

9.5 What's an ideal sending cadence?

For most markets, 1-2 listing blasts per week per agent list hits the balance between staying visible and avoiding fatigue. New listings and significant price changes justify immediate blasts; open houses often perform best when promoted 5-7 days in advance.

9.6 How do referral fees typically work in these networks?

Agent-to-agent referral fees often range from roughly 20-35% of the transaction side, paid at closing. Written agreements specifying percentage, timing, and scope are strongly recommended to avoid disputes and preserve relationships.

9.7 Can agent networks help with buyer leads too?

Yes - while listing promotion is the dominant use case today, some platforms support "buyer need" posts and two-sided marketplaces where agents publish buyer profiles that listing agents can respond to. This trend is early but expected to grow as networks mature.

9.8 How quickly will I see results from network campaigns?

Expect to see opens and replies within days, meetings within 1-4 weeks, and closed deals over a 3-6 month horizon, depending on local market cycles. Early engagement metrics are usually enough to judge whether a particular segment or message is working.

9.9 Which metrics matter most?

Key metrics include open rate, reply rate, meeting rate, deals closed per campaign, cost per deal, and overall ROI. Many agents find that hitting >25% opens and >1.5% replies correlates strongly with at least some closed business over time.

9.10 How can I make my flyers stand out?

Performance comparison shows targeted and AI-powered email campaigns dramatically outperform generic blasts across all metrics

Use high-quality visuals, clear benefit-driven headlines, specific property details, social proof (recent sales, testimonials), and strong calls-to-action tailored to recipient agents. Testing different layouts and messages - and reusing what produces the most replies - is the fastest path to sustained improvement.

Blastrow

Listing Promotions